Article

Home ownership and responsible borrowing

Homeownership is a major goal for Canadians, offering financial and non-financial benefits that contribute to long-term security. Canada’s banks play an important role as mortgage lenders, offering a range of mortgage options and professional advice, adhering to responsible lending practices, maintaining high standards for underwriting and risk management, and working with customers to ensure they can manage their debt.

What "in arrears" means

The CBA defines the term "in arrears" as mortgage payments that are overdue by three or more months. The number of mortgages in arrears is considered an economic indicator because it reflects how households are coping with debt over time.

Canada’s track record

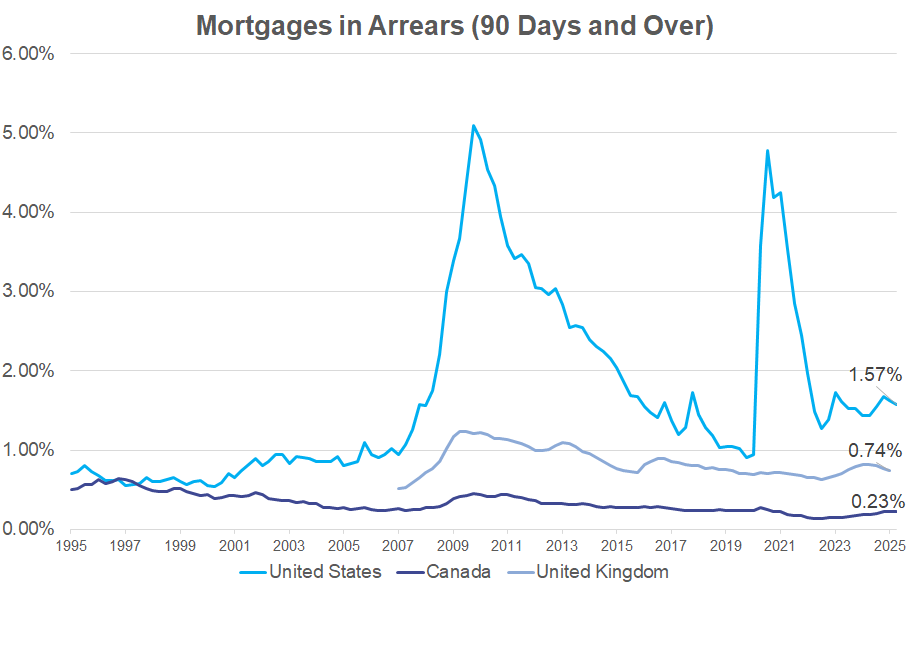

Canadians are generally careful borrowers. More than 99 per cent of mortgage holders at a bank in Canada are not considered seriously delinquent, and Canada’s arrears (90 days and over) rate remains one of the lowest among advanced economies.

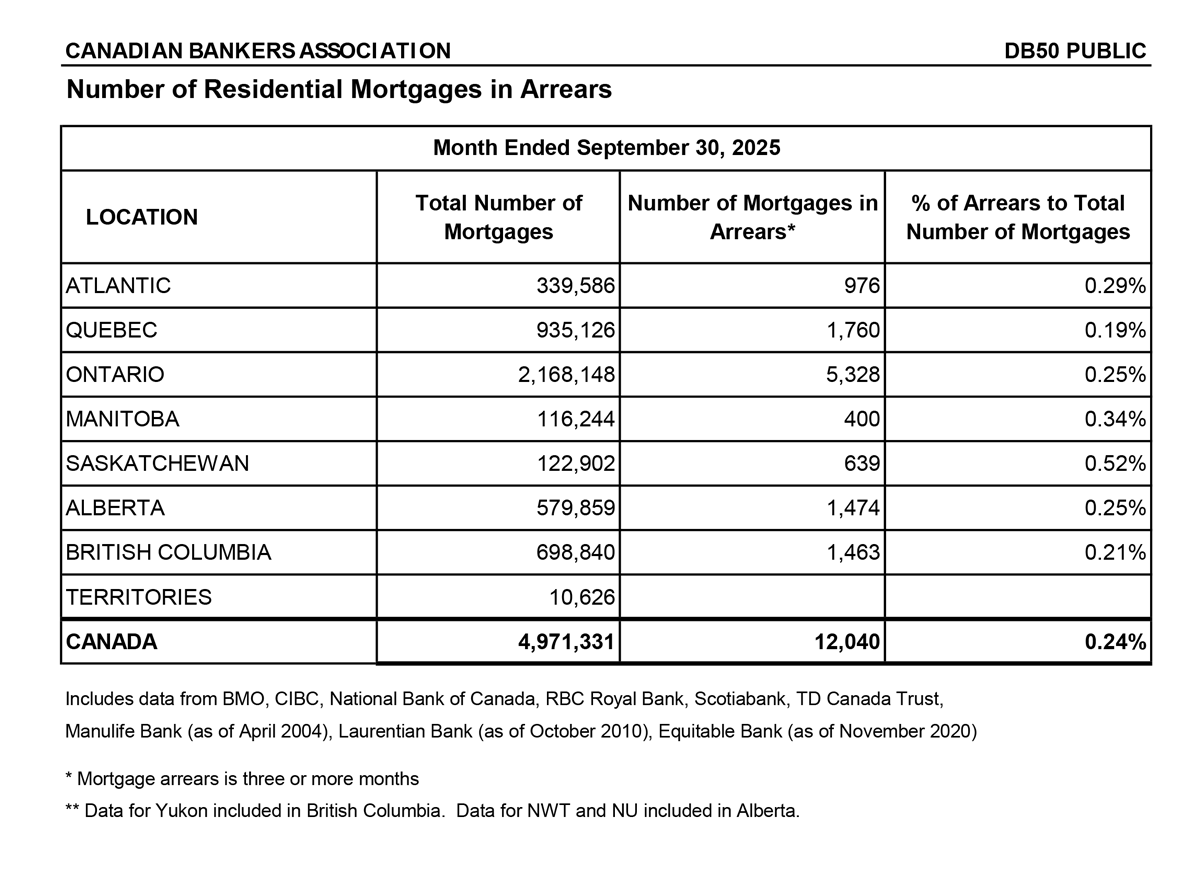

As of September 2025, the most recent statistics available, the national arrears rate was 0.24%, which means that less than a quarter of a percentage point of mortgages are in arrears. This is well below levels in the United States and the United Kingdom. While arrears rates in Canada have edged upward in recent months, they are still close to historic lows.

Chart: Number of residential mortgages in arrears as of September 2025

Why arrears rates could rise

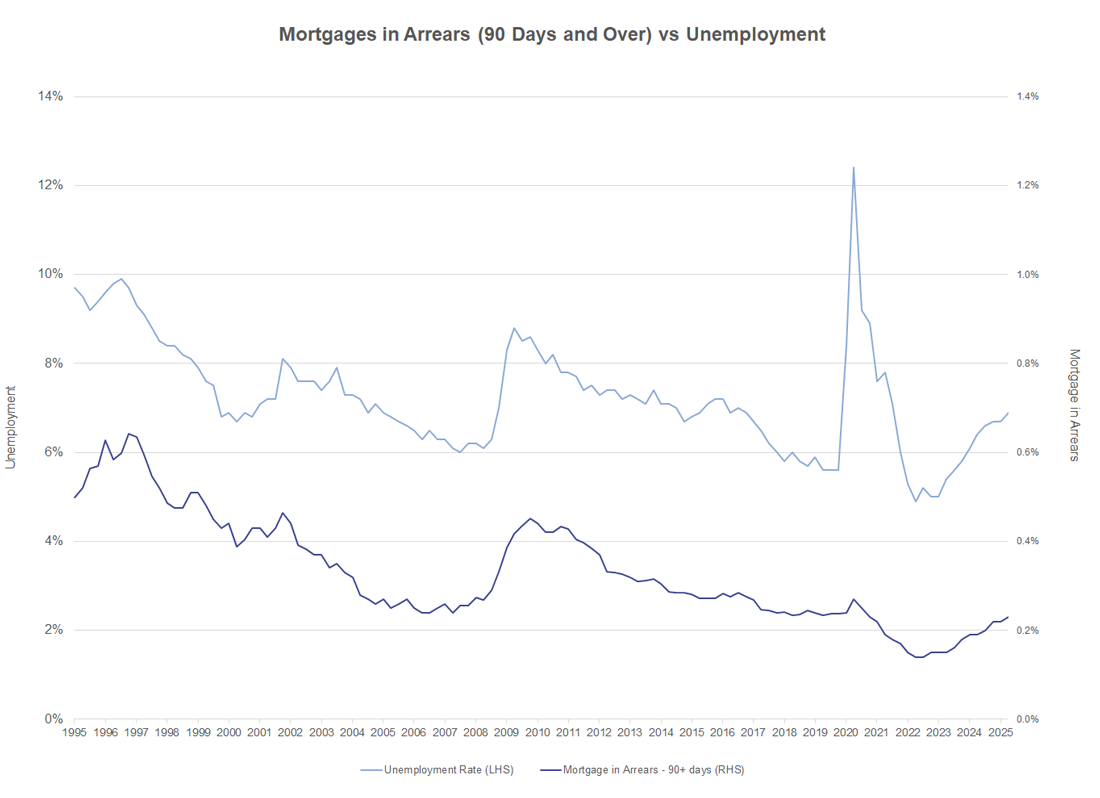

Missed mortgage payments in Canada have tracked closely with employment conditions (see Mortgages in Arrears (90 Days and Over) vs Unemployment chart above). If the labour market weakens and more Canadians face job losses, arrears rates are likely to rise as well.

Canadian borrowers have consistently maintained low mortgages arrears rates even throughout challenging periods such as the Global Financial Crisis and the COVID‑19 pandemic.

Support for Canadians experiencing hardship

Banks do not want to see their customers in financial difficulty. Healthy banks rely on healthy borrowers. When borrowers face challenges, banks work directly with them to find solutions. For example, banks are able to help by providing advice and flexible loan repayment arrangements such as allowing for lump sum payments, moving from a variable rate to fixed rate mortgage, loan consolidation or lengthening the amortization of the debt to reduce regular payments. They may also refer customers to a not‑for‑profit credit counselling agency if they feel it would be helpful. Learn more here: cba.ca/article/help-with-debt.

Banks also provide a number of resources and supportive measures to assist those who might need help in managing their money: cba.ca/article/financial-wellness.

Canadians who are struggling are encouraged to contact their banks early to discuss their situation.